$10,000 WI-Fi Money, 1 year, Zero Excuses. Part 2

*Not Financial Advice*

To reiterate, the best way to be successful in this endeavor is to have a clear plan on how you will quickly hit minimum spends, and get that money back in your bank account via manufactured spending. This will be covered in depth in the paid substack.

Day 1 Action Steps:

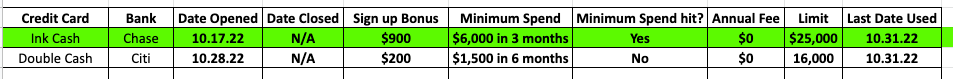

You apply to your first credit card. Once you get approved, you’ll set up your login/pw, and get the card in the mail within a few business days. Call the bank and see if it’s possible to expedite the card. Oftentimes they’ll do this at no additional cost. I STRONGLY recommend everyone set up a spreadsheet that tracks all their credit cards, annual fees, minimum spend etc. I started this game thinking I would get a few credit cards and now have hundreds (including employee cards). Keeping a detailed spreadsheet will prevent mistakes.

Once you have your card in hand, it’s off to the races. Put all your organic spend on this card and use your MS to hit the sign up bonus as quickly as possible. Once you’ve hit your sign up bonus, it’ll really only be useful for multipliers on category spend. Then, apply for another card and rinse and repeat.

In general, you don’t want to pigeonhole yourself to rewards cards that focus on a certain airline like United or Delta. The best rewards are flexible and convertible to cash, airlines, hotels, etc. Chase Ultimate rewards, American Express MR rewards, and Citi ThankYouPoints are the ones we’ll target as they are the most flexible. A detailed post will cover the pros and cons between each one shortly.

*Note* My twitter DM’s will be open the next week or so for anyone that needs help getting started and has any questions. After that, I’ll have a formal Q&A

Disclaimer: None of this is to be deemed legal or financial advice of any kind.